Carbon Trading 2.0

The effect of the Glasgow COP26 meeting continues to grow and is now propelling the carbon-trading market.

JANUARY 28, 2022

Author: CRAIG MELLOWEarly in November eight titans of 21st-century industry—including Amazon, Alphabet/Google, Microsoft and Netflix—formed the Business Alliance to Scale Climate Solutions, or BASCS. The setting, at the sidelines of the COP26 climate summit in Glasgow, Scotland, was more than symbolic.

Despite prevailing skepticism about such all-world jawfests, COP26 did achieve something of note in its 23rd hour and after five numbing years of negotiation: a global protocol for trading carbon credits and offsets, known to the climate cognoscenti as Article 6.4.

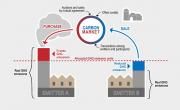

That’s a big deal, or could be, for a wide range of industries and financial investors. The carbon dioxide (CO2) spewed in order to power, say, an Amazon server in the US could hypothetically be neutralized by forests the company pays to plant in Central Africa or solar energy it finances in India.

The same goes for a Delta Airlines flight from Paris to New York, oil that Shell extracts from the Gulf of Mexico or fumes from a Cemex cement plant in Mexico—to cite a few companies that have set ambitious carbon-cutting targets.

An added refinement to Article 6 of the Paris Agreement, Article 6.4 lays out an accounting system, a set of international accounting standards (IAS) or generally accepted accounting principles (GAAP) in embryo, for a private-sector market that has been ad hoc until now. The key principle is a ban on so-called double counting: The seller of a carbon-cutting project can’t use it toward its own climate targets. “It’s a huge breakthrough,” says Pedro Martins Barata, senior director of climate policy at Environmental Defense Fund (EDF). “The voluntary carbon market has been exploding, but exploding without any type of norms.”

How huge in dollar terms? The voluntary carbon-credit market amounts to a measly $1 billion now. That could expand “10- to 20-fold” over the next decade, says Romina Graiver, a London-based partner at asset manager William Blair. That could accelerate to $200 billion by 2050, predicts Elena Belletti, Madrid-based head of carbon at energy consultant Wood Mackenzie. Sooner or later, we’re talking real money.

Volunteers and Draftees

Companies feel pressure to cut their carbon counts right now, though, for one of two broad reasons: They have to, or they want to. In the have-to column are cuts required by governments, what insiders call the compliance market. The European Union is leading the way here. The price of carbon credits on the EU’s internal exchange tripled last year as the commission in Brussels moved toward tighter targets. “Prices were driven by climate policy fundamentals,” Belletti says.

Other polities, from China to California (which often acts as a sovereign state on environmental issues), are also tightening the noose. Carbon-credit prices in the Golden State, which runs a joint market with Quebec, doubled in 2021. COP26 laid down a mechanism for credit trading between governments (Article 6.2, for those keeping score).

But the real excitement centers on the voluntary market—emissions that companies want to cut without a government requirement. The voluntary epicenter is the US, which has yet to enforce carbon caps or taxes except in California. Ripples reach from Mexico, where Cemex is pushing to be a global climate beacon, to Russia, where steelmakers like NLMK, Evraz and Severstal are mulling carbon diets.

The Russians are motivated by their large exports to Western Europe, where standards are high. “We will be subject to the EU’s carbon import tax by 2026,” notes Boris Sinitsyn, head of metals and mining research at Renaissance Capital in Moscow. The US-based giants are reacting to increasingly sustainability-minded investors, consumers and employees. Focus widened in recent years from resource extractors and exhaust belchers to Big Tech and the massive real-world energy sucked up to power the virtual economy. Netflix alone consumed up to 15% of the internet’s energy at its peak, EDF’s Barata reports.

The New Economy powers are responding, and that response will include carbon offsets. Microsoft bought 1.3 million tons worth of CO2 removal in 2020, or about 10% of annual emissions, chasing its goal of being “carbon-negative” by 2030. “Our members are moving from ambition to action on living in line with their values,” says Ameer Azim of Business for Social Responsibility, the San Francisco-based consultantcy that helped organize BASCS. “They have clear confidence that Article 6 can work as a backstop.”

But Is There Enough?

Growing demand for carbon offsets looks secure. Supply is a different story. Carbon-offset legitimacy is a moving target. Wind power in China, for example, might have qualified under Article 6’s distant ancestor, the late-1990s Kyoto Protocol, the EDF’s Barata says. Today it wouldn’t, because the market supports Chinese wind power anyway. (The Kyoto Protocol was torpedoed in 2001, when President George W. Bush withdrew the US from the agreement.)

The low-hanging fruit these days is planting or protecting forests in developing countries. Brazil’s International Chamber of Commerce projects that maintaining the Amazon jungle could earn the country up to $100 billion by 2030. That figure looks optimistic. Still, the global volume of forestry offsets more than tripled last year, Wood Mackenzie’s Belletti estimates.

The problem with forests is there are not nearly enough of them to soak up modern society’s carbon output. “At current rates, it would take five Earths’ worth of forested land to absorb annual carbon emissions,” Belletti points out.

Nor is every forestry project a slam dunk, offsetwise. “Just planting a tree doesn’t mean the right tree has been planted in the right place,” says Ursula Finsterwald, head of Group Sustainability Management at LGT, the private bank controlled by Liechtenstein’s princely family. Faraway forestry management may also impinge on the rights of native peoples, creating a PR headache rather than solving one.

Microsoft’s 2020 tender for carbon-offset projects, which others are studying as an example, indicates how arduous sourcing will be. The software pioneer received 189 proposals, which it winnowed down to 15 over half a year. “The types of project presented was very varied, and the quality very diverse,” William Blair’s Graiver comments.

Microsoft ended up relying on forestry for 1.1 million of its 1.3 million tons in declared offsets. The firm’s stated takeaway: “The market lacks clear carbon-removal accounting standards, particularly around the key criteria of additionality, durability and leakage.”

Stimulating Innovation

Optimists foresee that growing demand for carbon credits will lift the price per metric ton of C02. That will make a wider range of offset projects economical—particularly in carbon capture, which costs more than reforestation. LGT is investing in this theory. It lately entered a 10-year agreement with Climeworks, a Swiss company that will remove 9,000 metric tons of CO2 from the atmosphere and permanently store it beneath volcanic soil in Iceland.

“This is a business decision for us,” Finsterwald explains. “We pay them for the certificates.” An LGT partner company also owns 10% of South Pole, a Zurich-based offsets creator whose projects range from improved cooking stoves in rural China to “regenerative farming” in France and Belgium.

Finnish startup Puro.earth in Helsinki focuses on offset projects involving biochar. This ubiquitous substance, formed by decaying trees and grasses, can boost the carbon absorbency of agricultural soil. That could mitigate up to 660 million tons of CO2 a year by 2050, an Intergovernmental Panel on Climate Change report estimates.

Biochar is much cheaper than Climeworks-style atmospheric carbon capture, Puro.earth CEO Antti Vihavainen argues. And buyers don’t need to manage offsets at the ends of the earth. Puro.earth’s projects, three of which made the cut for Microsoft funding, are concentrated in Australia and Germany, along with Finland. “Carbon removal is a bit of a cottage industry now,” Vihavainen says. “We’re working with our suppliers to scale them 50 or 100 times.”

For that, or anything like it, to happen, those clear carbon-removal accounting standards of which Microsoft speaks will have to evolve from the framework laid down at COP26. Formally, this task falls to the United Nations, which organizes the global climate summits. UN technocrats will move at their own stately pace, William Blair’s Graiver predicts. “There are still a lot of hurdles to making this operational,” she says. “It should take one to three years.”

The good news is that a plethora of NGO and industry organizations are pushing the pace of change. Airlines may be leading the way, with their (government-imposed) Carbon Offsetting and Reduction Scheme for International Aviation, or Corsia. This now requires carriers to offset emissions from international flights, with the goal of freezing pollution at 2020 levels. Unchecked, airlines’ carbon footprint would increase another 50%, or 300 million tons a year, by 2035, the International Air Transport Association estimates.

The COP26 rules will likely make offsets more expensive, says Laurent Donceel, senior policy director at trade body Airlines for Europe. That will push tougher choices between buying them or cutting emissions by “investing in sustainable aviation fuels or the renewal of their fleet.”

The tech/consumer giants uniting in BASCS have access to an alphabet soup of third parties vying to vet their offset projects: Gold Standard Foundation, Integrity Council for the Voluntary Carbon Market and the Verified Carbon Standard program of Verra, to name a few. “For the voluntary market, it’s all down to reputation and doing their own due diligence,” the EDF’s Barata says. “But there are organizations out there to separate the wheat from the chaff.”

More good news is that everybody around the world, or a critical mass, now understands the urgency of checking carbon emissions: industry, government, investors and consumers. Oil companies themselves are looking to molt into green pioneers, at least rhetorically. “Our clients realize the world is heading toward an energy transition,” Wood Mackenzie’s Belletti says. “They’re looking for how they can provide decarbonization solutions in carbon capture and storage. They are also looking at diversifying into renewables.”

The burning question now is how fast companies and nations can produce these solutions—and at what cost, in both value and emissions. Carbon markets and offsets have a role to play. One day, the Article 6 agreements from COP26 may be looked back upon as a Magna Carta for the multibillion-dollar trade to come—hopefully not too late.