Carbon Trading 2.0

The effect of the Glasgow COP26 meeting continues to grow and is now propelling the carbon-trading market.

JANUARY 28, 2022

Author: CRAIG MELLOWEarly in November eight titans of 21st-century industry—including Amazon, Alphabet/Google, Microsoft and Netflix—formed the Business Alliance to Scale Climate Solutions, or BASCS. The setting, at the sidelines of the COP26 climate summit in Glasgow, Scotland, was more than symbolic.

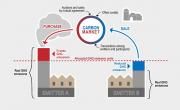

Despite prevailing skepticism about such all-world jawfests, COP26 did achieve something of note in its 23rd hour and after five numbing years of negotiation: a global protocol for trading carbon credits and offsets, known to the climate cognoscenti as Article 6.4.

That’s a big deal, or could be, for a wide range of industries and financial investors. The carbon dioxide (CO2) spewed in order to power, say, an Amazon server in the US could hypothetically be neutralized by forests the company pays to plant in Central Africa or solar energy it finances in India.